Metaverse’s Evolvement in the Korean Market

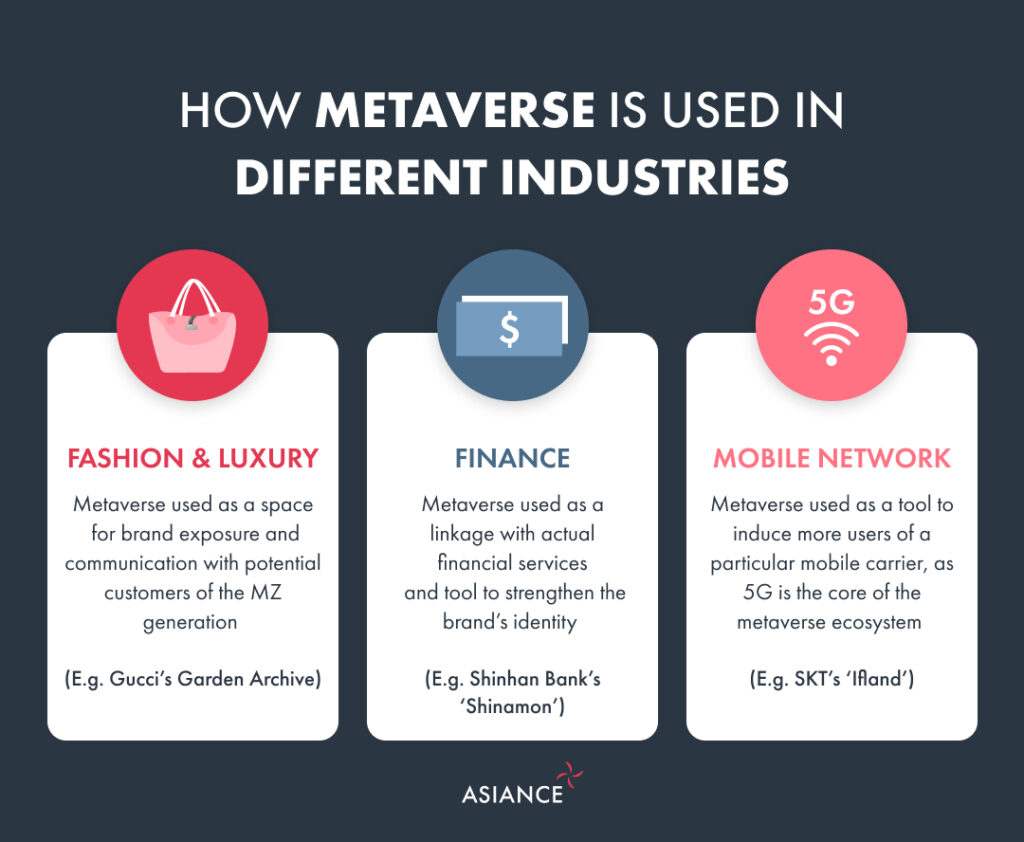

Following our last post, today we will take a closer look at noteworthy cases of the metaverse in the current Korean market. According to the “Growth of the Metaverse Industry and Regulations of the Digital Generation” report published by the Korea Internet Enterprise Association in November 2022, the Korean metaverse economy is likely to reach 400 trillion Korean won by 2030. The expected expansion is due to the continuous spread of K-contents and various industries’ active usage of the metaverse such as the fashion, financial, and mobile network industries within Korea. Today, we will learn in detail how representative brands from each industry utilize the metaverse.

Fashion and Luxury: Gucci’s Garden Archive Recreated in Zepeto

Looking into the fashion industry, many brands are using the metaverse as a tool to target consumers of the MZ generation. In particular, luxury brands such as Gucci, Louis Vuitton, and Balenciaga have actively entered the metaverse market, especially after the outbreak of COVID-19. In an environment where adaptation to digitalization was necessary, the metaverse was used by luxury brands as a way to strengthen brand communication with potential customers of Generation Z. This is because the metaverse space secures a new consumer audience and is linked to opportunities with various marketing strategies such as brand exposure and sponsorship proposals. For example, in the first half of 2022, Gucci implemented the Gucci Garden Archive in Zepeto, providing a service to experience the offline exhibitions held at DDP online. 9 out of the 13 offline exhibition sections were implemented on the Zepeto World Map. The exhibition could be explored anywhere, anytime, by all people. It also virtualized some Gucci items on Zepeto, providing users with a fresh experience of wearing and purchasing them online. As such, various fashion brands, including luxury goods, use the metaverse in various ways as a space for brand exposure and communication with the MZ generation.

Finance: Shinhan Bank’s own Metaverse Platform ‘Shinamon’ and KB Financial Group’s Integration of the Metaverse with ESG Management

Recently, marketing competition using the metaverse has become increasingly fierce, even among large domestic banks. In order to secure new customers, especially MZ generation customers, financial companies are implementing their brand identity and characteristics in their metaverse services. For example, in November 2022, Shinhan Bank established its own metaverse platform called “Shinamon” for the first time in the financial sector of Korea. Within Shinamon, a digital token called “Churros” can be collected through participation in games or events. According to Shinhan Bank, it is pushing the metaverse for linkage with actual financial services, providing benefits such as applying preferential interest rates to customers who regularly pay in Churros. In addition, KB Financial Group emphasizes its social role by combining the metaverse and ESG management to strengthen its branding. In May 2022, those who participated in the “Planting My Tree” project in the K-Bee Zone implemented in Roblox got to have an actual tree with their name planted by the KB Financial Group. Thus, banks are using the metaverse to not only drive more potential customers but also to enhance their brand image by integrating it with other factors.

Mobile Network: SKT’s Ifland, Now a Rising Competitor of Naver Zepeto

The mobile network industry, along with the game industry, is also very active in using the metaverse. Due to the fact that the metaverse uses 5G mobile communication, which is the core of building a metaverse ecosystem, it is understandable why the mobile network industries are investing in the development of metaverse services. A representative example is the mobile carrier SKT, which launched a metaverse platform called “Ifland” in July 2021. Ifland means a place (land) where many possibilities (ifs) that anyone wants to be, do, meet, and go become a reality. Using K-pop content, SKT has developed various services such as producing popular content with overseas partners, decorating avatars, and point systems, making it easy for anyone to enjoy the metaverse. Recently, Ifland has been launched simultaneously in 49 countries around the world, targeting the global market beyond Korea. According to SK Telecom, they will chase Naver Zepeto, which is currently Asia’s No. 1 metaverse platform. Specifically, by 2025, the monthly number of users (MAU) is predicted to rise from 1 million last year to more than 30 million by 2025.

Conclusion

Today, we examined notable metaverse cases of each industry in Korea. Many brands and companies are using the metaverse to secure and obtain potential customers in advance, especially the MZ generation. Looking at how the metaverse platform is spreading in various fields such as the fashion, financial, and mobile network industries, we were able to check how Korea’s metaverse services are spreading widely regardless of industry type. Let us all keep an eye on the upcoming trends and direction of the metaverse in Korea. Then we will wrap up the last Insight posting of 2022 and come back with a new post next year. Happy New Year, everyone!

Are you interested in Asiance’s insights?